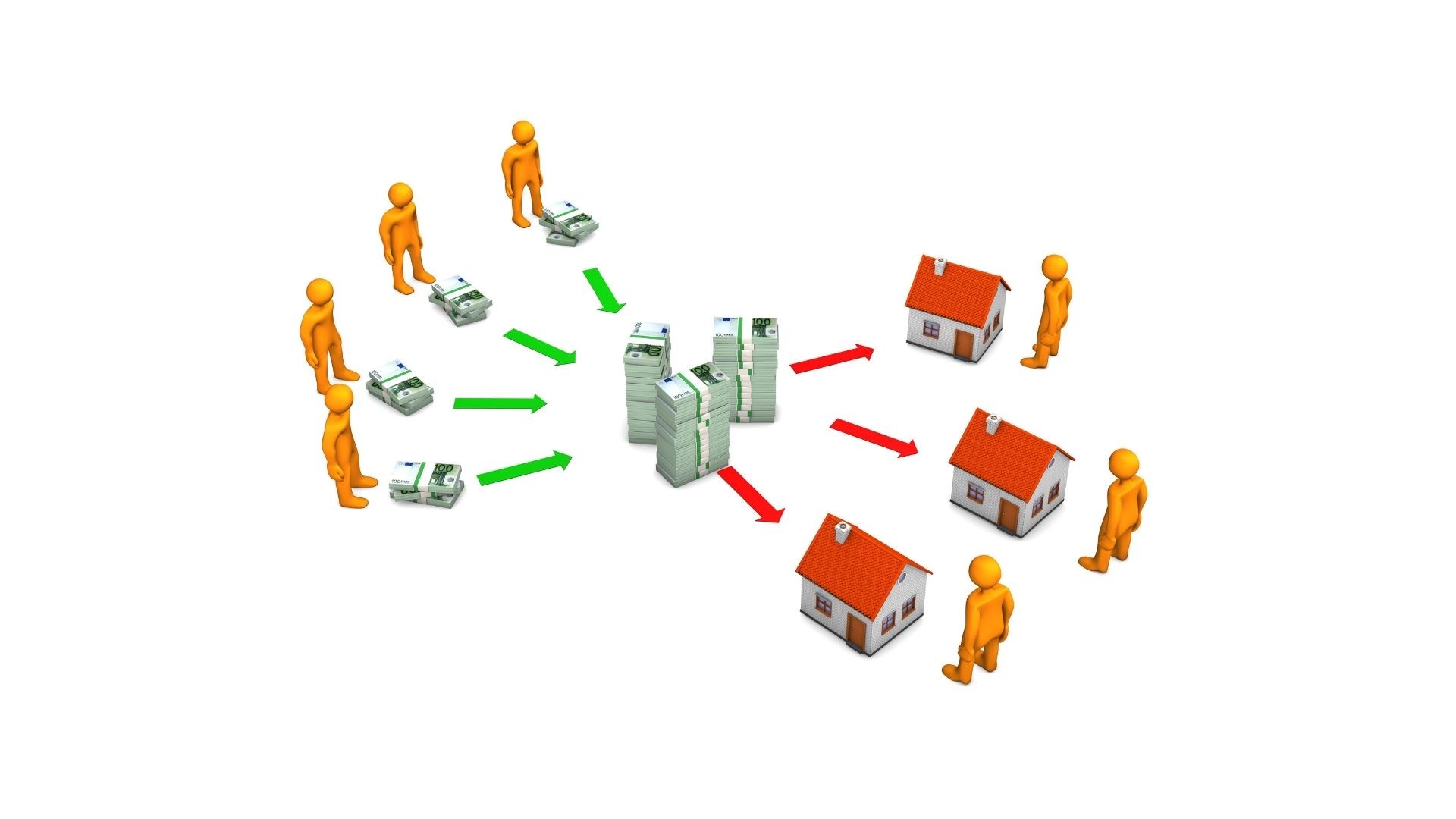

Two is better than one! It may or may not apply to people. But, when it comes to availing a home loan, two is always better than one.

The discussion here is in the context of the joint home loan. Many people in India apply for a joint home loan. It not only helps them get the approval for a higher amount but even avail housing loan tax benefits.

Let’s know more about the benefits of availing of a joint home loan in this post!

Also read and know about “7 ways to double your money“.

- It comes with an increased home loan eligibility

A home loan comes with a longer repayment tenor. The approval for it is give only to those who can repay EMIs on time. If one applied for a home loan and wants a large amount to fund a new home, he/she may not be eligible. A lender may award them a lower amount. It could be due to different reasons. It is where applying for a joint home loan can help. Applying with a co-applicant having a robust CIBIL score, repayment and income record can lead to increased home loan eligibility. Since the approved amount will be more, you will be able to buy a property of your choice. A co-applicant could be anyone from your spouse to relatives, parents and friends.

2. Helps you avail of higher housing loan tax benefits

When you apply for a joint home loan, you may be available for bigger housing loan tax benefits. It is because a co-applicant is able to enjoy housing loan tax benefits separately. If they are co-owners of the property that you are buying, they may pocket such benefits. On the home loan repayments for a principal amount, you may enjoy up to Rs.1.5 lakh under section 80C. On repaying the home loan interest charges, you may be eligible to avail of a deduction of up to Rs.2 lakh. As per section 24 of Income Tax Act.

These housing loan tax benefits are available only if the property is self-occupied. For let out homes, there is no limit. The entire interest amount payable could be claimed as deductions. Another home loan tax benefit for a joint applicant is that each borrower is applied separately. Hence, joint home loan tax benefits can easily help you save big on repayments.

3. Special home loan interest rates for women co-owners

From Government to lenders, women customers are always welcome everywhere, and availing of a home loan is not an exception. Yes, many lenders offer a discounted home loan interest rate offer to women co-applicants. The offered rate of interest could be a few basis points lower than the actual interest rate. To avail of this benefit, a woman ought to be the sole or the joint owner of the property. She also needs to be an applicant or a home loan co-applicant.

Availing of a joint home loan means collaborative responsibility

When you apply for a joint home loan, it becomes the responsibility of both applicants to repay the loan on time. Joint owners may make the EMI payment on their own or via a joint bank account.

Despite having diverse benefits, many people do not apply for a joint home loan account. Why? It is because since repayments are a shared responsibility, any default on the part of an owner means pressure on another applicant to repay.

If the second applicant doesn’t pay on time, it may strain the outlays of the other borrower.

When is it best to apply for a joint home loan?

Applying for a joint housing loan is beneficial only when you intend to acquire a significant amount. It is also availed to buy or invest in a bigger home.

Besides these perks, a joint home loan also helps one to bring down the overall price of the home. It is because of the vital housing loan tax benefit available to both borrowers.

Also, the shared responsibility to repay the home loan lessens the repayment burden.

You should apply for a joint home loan only when you are sure of another person’s creditworthiness. If not, you will be forced to pay the EMI alone, and it will strain your outlays for sure.